Mandatum AM AIFM Ltd

Mandatum Alternative Investment Funds

Mandatum AM AIFM Ltd

Mandatum Alternative Investment Funds

Mandatum offers alternative funds investing in real estate and private equity. Our alternative funds are aimed at long-term and professional investors and are managed by an experienced investment team.

Mandatum AM Finland Properties II

Special investment fund (non-UCITS, AIF) investing into Finnish properties. According to the fund policy the target is to invest into diversified assets that have significant cash flow and development potential, located mostly in the top 20 cities/areas of Finland. The fund’s subscriptions have been temporarily suspended.

Our goal is to have an annual return of 8-10 % to our investors after expenses, however it should be noted that there are always risks attached to investments. High-yield real estate investments have higher risks and are managed through systematic and professional portfolio management.

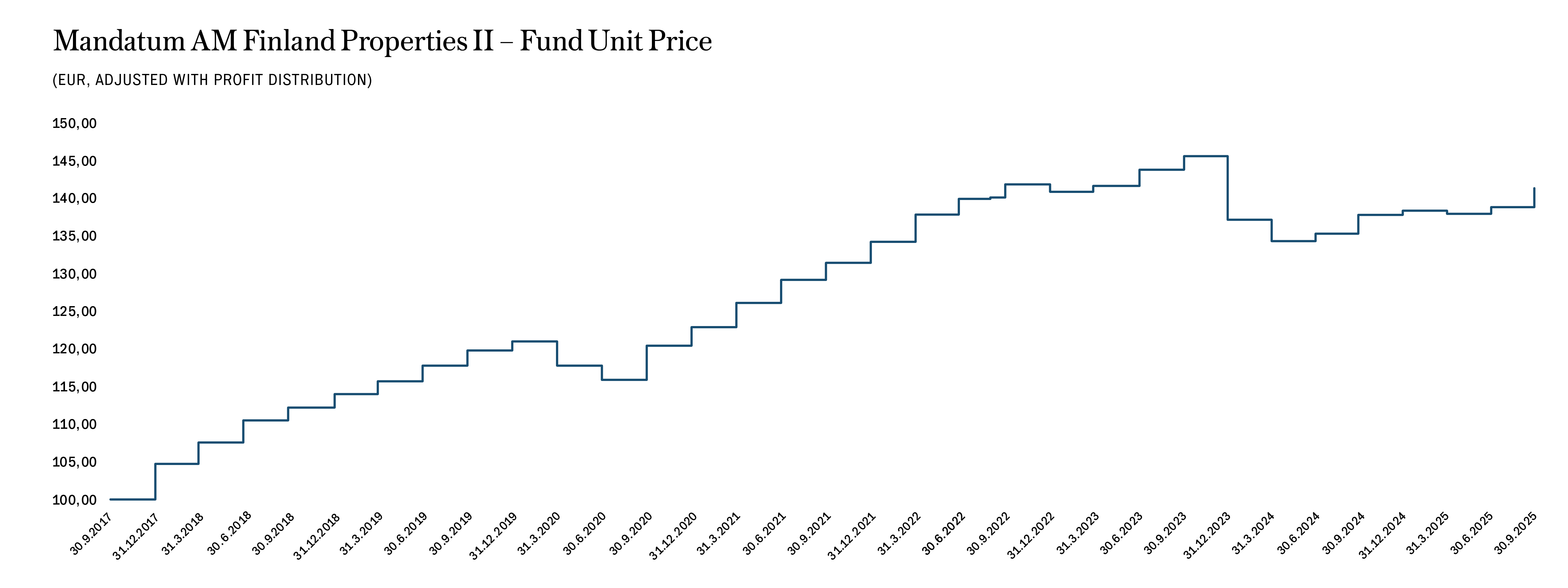

Fund unit value (EUR): 30 September 2025: 117,45 (139,74 adjusted for profit distribution).

January 23, 2024: Special investment fund Mandatum AM Finland Properties II is temporarily suspending redemptions and subscriptions of fund units

Mandatum AM AIFM Ltd has decided to temporarily suspend redemptions and subscriptions of fund units in the Special investment fund Mandatum AM Finland Properties II (Fund). The interruption is based on a decision made by the company’s Board of Directors on 23 January 2024.

On 3 October 2023, Mandatum AM AIFM Ltd announced that it is postponing the payment of redemptions linked to the September 2023 redemption date in accordance with the Fund’s rules. As a consequence of the nearly unprecedented slowing down of the property transaction market, it has not been possible for the Fund to sell properties at a sensible price and thus acquire sufficient cash assets to pay out redemptions.

According to KTI Finland, which produces information on the real estate market, the property market’s transaction volume in 2023 was 64 per cent lower than in the preceding year, totalling roughly EUR 2.6 billion1. The significant slowing down of the property market’s transactions can be attributed to the rapid spike in the interest rate level and difficulties in the availability of financing. The market’s transaction volume in 2023 was similar to the years after the 2008 financial crisis, when the size of the transaction market was also significantly smaller than it is now. In a quiet market, there are fewer buyers and transaction processes take longer.

Portfolio management has used the means available for managing liquidity. In the current situation, the Fund cannot accept redemption or subscription orders until market activity has sufficiently returned to normal. In Mandatum AM AIFM Ltd’s view, it is in the interests of the fund unit holders to temporarily suspend redemptions and subscriptions.

Despite the exceptionally challenging liquidity situation, the fundamentals of the Fund’s real estate portfolio are in order

The strategy, which leans on a strong cash flow, has proven to be a defensive element against changes in return requirements and rising interest expenses. The real estate portfolio’s net return in relation to market values at the turn of the year is 8.6% (so-called initial return). The Fund’s economic occupancy rate is historically high. The rental market and new leasing are at a good level, and rents are being raised in line with the indices. The Fund’s moderate loan-to-value ratio has been ensured through a long-term financing agreement. Most of the debt in use has been hedged.

Mandatum AM AIFM Ltd continuously assesses the means available for increasing cash assets. Mandatum AM AIFM Ltd continuously monitors the continuation of the grounds for temporarily interrupting redemptions and subscriptions. The temporary suspension of redemptions and subscriptions will continue for as long as there are grounds for it. The temporary suspension of redemptions and subscriptions does not require any actions from the fund unit holders.

Additional information:

For more information, please send an email to fundservices@mandatumam.com.

1 KTI Finland: Vuoden 2023 kiinteistökauppavolyymi jäi 2,6 miljardiin euroon (https://kti.fi/vuoden-2023-kiinteistokauppavolyymi-jai-26-miljardiin-euroon)

Risk is always inherent in investments. More detailed risk descriptions are available in the Fund’s product material found from this webpage.

Past performance does not predict future returns. Investing includes risks and investors should familiarize themselves with the Fund documentation and read the full risk descriptions of the Fund.

Documents

Statement on principal adverse impacts of investment decisions on sustainability factors

Mandatum AM AIFM Ltd considers principal adverse impacts (“PAI”) of its investment decisions on sustainability factors in accordance with Article 4(1) of the Sustainable Finance Disclosure Regulation (EU) 2019/2088 (“SFDR”). The statement on principal adverse impacts on sustainability factors of Mandatum AM AIFM Ltd can be found here.

Mandatum’s policies on sustainability risks are described here:

Mandatum's policies on sustainability risks - Mandatum Asset Management (mandatumam.com)

Mandatum AM Growth Equity II

According to the fund policy, Mandatum AM Growth Equity II ("GE II") invests into Nordic growth companies that are past their start-up phase and are looking for growth capital that will help them scale their business internationally. GE II will be the second vintage of MAM’s growth equity strategy, which was formally set up in 2020. The strategy is industry-agnostic while focusing on selected themes that it considers attractive. The average investment per target company ranges between €10-30 million. The substantial size of the investments allows GE II to differentiate itself from other managers.

The fund's strategy embraces a hands-on approach and the combination of significant capital injection and active support resonates well with potential target companies. In addition, MAM Private Equity is flexible in terms of deal structuring as a variety of options are available for target companies, including primary and secondary investments.

The strategy has a long heritage in Nordic minority investments, and it leverages our deep experience built over 30 years of private equity investing. This longstanding history has generated a broad contact network of high-quality relationships and partnerships with GPs, LPs, management teams, and portfolio companies.

Responsible Investing

At Mandatum, responsible investing involves a comprehensive assessment of the impacts, risks, and opportunities associated with environmental, social and governance (ESG) factors when making investment decisions.

Read more about investing with us

We understand the goals and responsibilities of institutional and other professional investors given our perspective and experience as an end-investor.

Contact details

Mandatum AM AIFM Ltd

c/o MAM PL 1221, 00101 Helsinki

fundservices(at)mandatumam.com

Legal disclaimer

Welcome to Mandatum AM AIFM Ltd’s Alternative Investment Funds website

Before you proceed by choosing the right option for you, please take a moment to review and accept the information below.

The investment funds and the information contained on this website are intended solely for prospective investors from the jurisdictions where these investment funds have been passported and authorized for sale. Such jurisdictions are Denmark, Finland, France, Netherlands , Norway, Spain and Sweden. Please note that all funds may not be passported and authorized for sale in all these jurisdictions. It is your responsibility to be aware of the applicable laws and regulations of your country of residence. Further information is available in the Prospectus or other constitutional document for each fund.

By clicking the Yes below, you accept that you are residing in one of the jurisdictions mentioned herein.

The information contained on this website is provided solely for informational purposes and has no contractual value. It should not be construed as an offer or solicitation for the purchase or sale of interest in any fund mentioned herein.

If you’re not a resident in one of the jurisdictions mentioned above, we kindly ask you to click No below and contact your sales representative for any specific questions.

Are you resident in one of the jurisdictions mentioned herein: