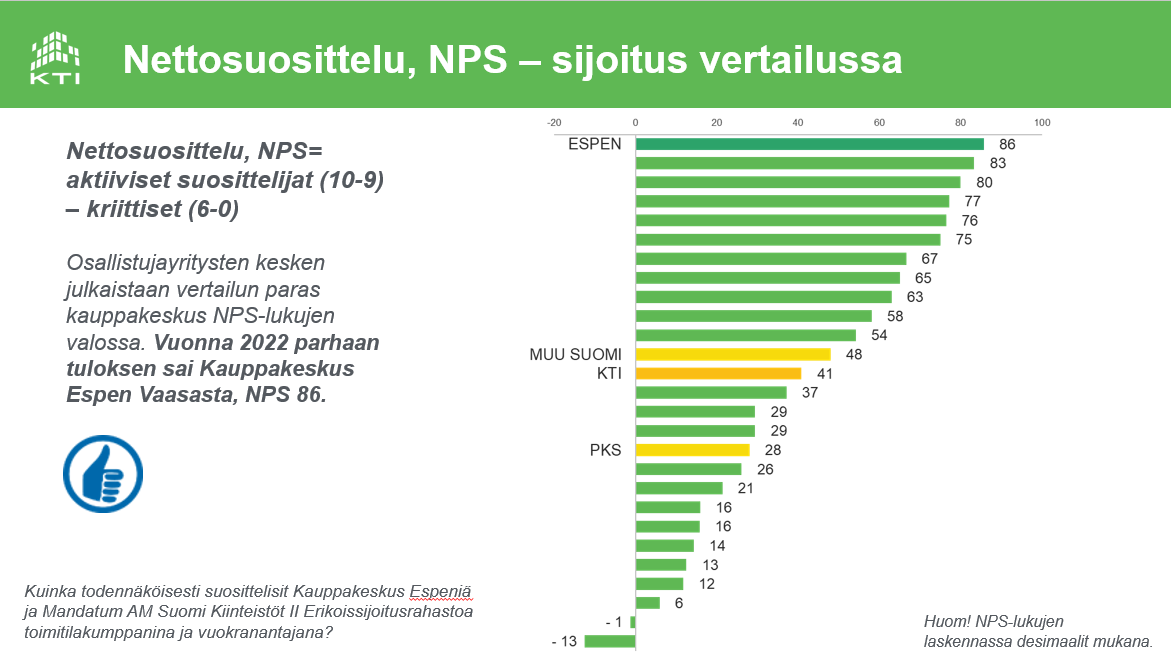

KTI Finland conducts an annual tenant satisfaction survey, this year involving 24 shopping centres around Finland. The survey measured, among other things, tenants’ willingness to recommend with the question: How likely is it that you would recommend Espen shopping centre and Mandatum AM Finland Properties II special common fund as a business premises partner and lessor? Essen shopping centre, located in Vasa, Finland, came first in the survey.

The overall satisfaction of Espen’s tenants with the shopping centre’s operations, management, marketing and communications came in at the top in the national survey. Newsec is responsible for the property’s commercial management, business premises leasing and technical maintenance, and Mandatum Asset Management’s real estate management team is in charge of corporate governance.

“Our goal is to maximise our presence in the daily lives of the shopping centre’s tenants and to gain a better understanding of their operations. I feel that the Espen shopping centre has an open and present management style that drives us forward and embraces renewal. I am thrilled and impressed by the results, which show that we have succeeded in our goals. Our good and close collaboration with the property owner, tenants and partners has helped us develop the shopping centre – a path we will continue to follow,” says Shopping Centre Manager Katriina Karkkola.

Despite the Covid pandemic and other global challenges, the entire shopping centre and property have been developed actively both commercially and in terms of its ways of operating in recent years. A major energy renovation has also been carried out, improving the energy efficiency of the entire property.

“Espen has recently welcomed several new tenants to both the shopping centre and office premises. The occupancy rate is already almost 100 per cent, which has led us to begin developing new commercial premises for new operators. A major revamp of the shopping centre is in the works, and is being planned to increase the attractiveness of the entire shopping centre and Vasa city centre going forward. The plan is to develop and convert Nordea’s current premises for commercial use. The property is a historically significant part of Vasa, which is why it is wonderful to be able to develop it in tune with the times and offer gorgeous premises for new tenants. This means new store openings next year too,” Karkkola says.

“We are extremely happy with the results Espen received in the tenant satisfaction survey and with the commercial development of the property during our ownership. We will continue this development and strive to create the most diverse and attractive business and service offering possible,” says Tea Siivola, Commercial Director of the special common fund at Mandatum Asset Management.

Mandatum AM Finland Properties II, a special common fund managed by Mandatum AM AIFM Ltd, acquired Espen in February 2020. The real estate complex built in 1926–1991 and renovated in 2018, which stands alongside the market square, houses 18,700 m2 of lettable retail, office, entertainment and hotel space and around 65 tenants.

The special common fund invests in properties in Finland’s 15 largest cities. The fund largely invests in high-cash-flow properties outside the capital region.

For more information, please contact:

Tea Siivola, Commercial Director, Mandatum Asset Management

tea.siivola@mandatumam.com, +358 400 179 048

Katriina Karkkola, Shopping Centre Manager, Newsec Asset Management Finland

katriina.karkkola@newsec.fi +358 50 449 4584

The special common fund Mandatum AM Finland Properties II is an alternative fund managed by Mandatum AM AIFM Ltd, and the fund’s asset manager is Mandatum Asset Management Ltd. This publication is marketing material. Prior to making an investment decision, investors must at least read the fund’s key investor information document (KIID) and the risk profile described therein, as well as the fund rules and prospectus.

The relevant documents are available at https://www.mandatumam.com/mandatum-am-aifm.